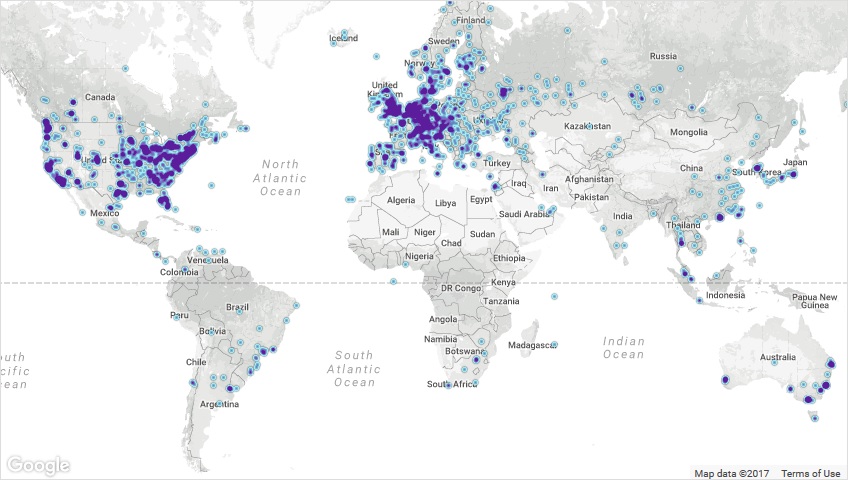

The above map shows the concentration of Bitcoin nodes around the world (Date: 6 November 2017).

Bitcoin nodes are the computers that make up the Bitcoin network, because they run Bitcoin software which allows people to broadcast transactions into the Bitcoin network, and they also store the Bitcoin blockchain, which is a collection of all the Bitcoin transactions that have ever occurred.

All the nodes working together is the Bitcoin network.

Moving on, here is a list of countries, sorted by their GDP: Wikipedia

GDP is the total revenue (not income) a country has collected during a certain time period, thanks to the combined work of its inhabitants.

What is instantly clear from this analysis, is that Bitcoin nodes are only concentrated in the top 20 countries with the highest GDP, and countries with a very low GDP have few to no Bitcoin nodes.

High-GDP countries are probably using the Bitcoin network for asset storage. Low-GDP countries probably have too much debt, and therefore are just surviving instead of thriving. Hence, low-GDP countries cannot afford to build the infrastructure to sustain Bitcoin nodes, like high-GDP countries can.

The question then becomes, if low-GDP countries adopt Bitcoin as their official currency, what would happen to the Bitcoin price?

The Bitcoin price would steadily increase forever, since the demand for Bitcoin increases forever, but the supply is practically limited to 21 million BTC.

To estimate the final Bitcoin price, let’s assume that the top 20 high-GDP countries control the current Bitcoin price.

The current price (6 November 2017) is US$7,000 per Bitcoin.

With about 16 million Bitcoins currently in circulation, that amounts to a total value of $115,500,000,000 = about $0.1 trillion.

We predict a 16300% increase to $1,142,857.00 per Bitcoin, if all countries adopt Bitcoin. That’s over 1 million dollars per Bitcoin.

We approach the prediction by asking, how much Bitcoin should be in circulation for everyone’s day-to-day activity on Earth?

The highest minimum wage in the United States is $15 per hour, which is approximately $3,000 per month. Let’s assume there’s 8 billion economically active people (8,000,000,000) on Earth. Thus, the total market value of Bitcoin should be $3,000 x 8 billion = $24 trillion.

This means, Earth needs a market value of $24 trillion to sustain a global economy with 8 billion working people.

To get the value per Bitcoin, we take $24 trillion / 21 million BTC = $1,142,857.00 = over $1 million per Bitcoin.

Even though the current total value of Bitcoin in circulation, as well as asset reservation, is quite large at $0.1 trillion, $24 trillion more than covers the total required by today’s standards, as well as the needs of tomorrow.

With the current total global GDP being $74 trillion, our estimate may indeed be off by a factor of 74/24 = 3, which means, the price per Bitcoin could indeed end up anywhere between $1 million and $3 million.

This will not happen in the near future, but it will happen in our lifetime.